A new study on Creative Value Chains will be presented for the first time at MIDEM on 9 June – a leading business event for the international music industry in Cannes.

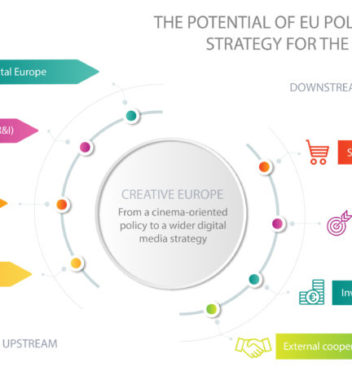

Requested by the European Commission (DG EAC) and led by IDEA Consult, the study is a follow up to KEA’s groundbreaking 2006 research on the Economy of Culture in Europe which assessed the economic and social importance of the Culture sector for the first time at EU level. It looks at the impact of the digital revolution on the different creative value chains (visual arts, performing arts, cultural heritage, artistic crafts, book publishing, music, film, TV and broadcasting as well as multimedia). This study analyses how value is created and distributed within each cultural and creative sector, from the conception to the commercialisation of cultural goods and services.

The Music industry was the first to be impacted by digital distribution with dramatic effects: its revenues from the sales of physical music plummeted by 60% between 2000 and 2015.

Against this backdrop, the music industry spearheaded the adaptation of the cultural sectors to the digital revolution, shifting from business models centered around ownership (physical sales and download-to-own) to solutions based on access such as streaming. Very few other sectors found ways to monetise content online – revenues from digital music have topped physical sales since 2015. The study shows a challenging inverse correlation in the perceived value of music persists: while the music sector has never been more consumed and important to online businesses than today, the billions of ad-supported streams generated less revenue in 2014 than the sale of vinyl records – a value gap also observed in the film, visual arts and book publishing sectors.

However, the digital revolution has not led to a drastic reconfiguration of the actors involved; new actors such as large tech companies (Google, Amazon or Apple) have entered the market, thus increasing the complexity of the value chains in the distribution segment and affecting the power balances in several value chains. The study notes that the digital shift did not, in general, lead to disintermediation between creators and distribution. Structurally the digital shift leads to increased market concentration in the content sector. Save for some players such as brick and mortar retailers, many actors that have dominated the value chains before digitisation still play a pivotal role in the current economic organisation. Some sectors whose future was doomed such as theaters have thrived, whilst distributors of audiovisual products have seen the highly profitable DVD business wiped out (diving from EUR 8 billion in 2010 to EUR 5.3 billion in 2014). The long tail has yet to materialize for independent players and collective bargaining may become a trend in the future. Artists in the music field have to work harder touring and performing or connecting through social media to develop a fan base.

The study considers the importance of regulation in maintaining the status quo and shielding some industries (notably cinema) from the full impact of the digital shift, at least momentarily.

This is the first time a study gives a European overview of the value chains of the different cultural and creative sectors.

The study provides recommendations for policy makers to develop an enabling environment for European Cultural and creative industries (CCIs), which represent 4.4% of the European GDP and 3.8% of jobs (8.3 million people), to remain competitive. In particular we suggest stimulating the CCIs to find new co-operation models to surmount cultural enterprises’ general lack of scale, to overcome linguistic fragmentation and to join forces to increase their bargaining power. The Merlin initiative showed that MSMEs from the cultural sector can gain access to large digital companies benefit much more from the digital single market through federation and cooperation.

The full report and the executive summary (French and English) is available on here.

The study was conducted by a consortium led by IDEA Consult, including KEA and the Brussels-based University VUB-SMIT.

IDEA Consult (www.ideaconsult.be) is a private economic research and consultancy organisation, founded in 1998, located in Brussels. IDEA Consult provides research-based consultancy where economic research is translated into strategic advice for companies and government institutions.

KEA is a Brussels-based research and advisory company specialising in providing support and research in relation to culture and creative industries (CCIs) since 1999. KEA has authored numerous studies on CCS on behalf of the European institutions. KEA has offices in Brussels and Shenzhen.

VUB-SMIT (www.smit.vub.ac.be/): founded in 1990 at the Vrije Universiteit Brussel, the Centre for Studies on Media Information and Telecommunication (SMIT), has ample expertise in research on the cultural and creative sectors, focusing its research on the impact of digitization on these sectors and related policies.

For further information on this study, please contact the Project Manager for KEA contribution: Arthur Le Gall, alegall@keanet.eu