KEA European Affairs is pleased to have co-authored the updated “Market Analysis of the Cultural and Creative Sectors in Europe” commissioned by the European Investment Fund (EIF) under the Cultural and Creative Sectors (CCS) Guarantee Facility Capacity Building programme.

The market analysis captures the figures behind European CCS’s growth before the pandemic. It also outlines the key trends that are reshaping the CCS in light of digitisation and technological innovation, increased environmental consciousness, new business models and more collaborative ways of working.

The CCS are worth investing in

The market analysis reveals how the CCS are worth investing in:

- It represented, on average, 5.5% of EU Member States’ value added in 2017.

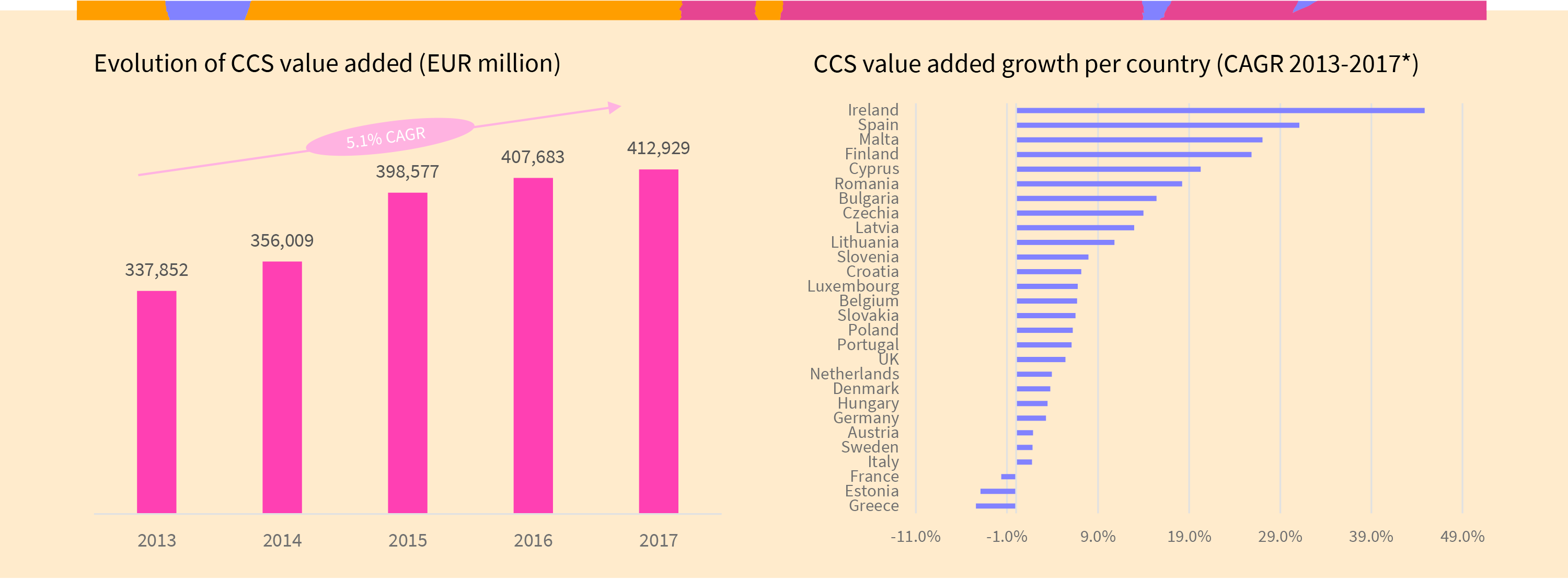

- The value added has been growing at a fast pace during the period 2013-2017 (CAGR of 5.1%).

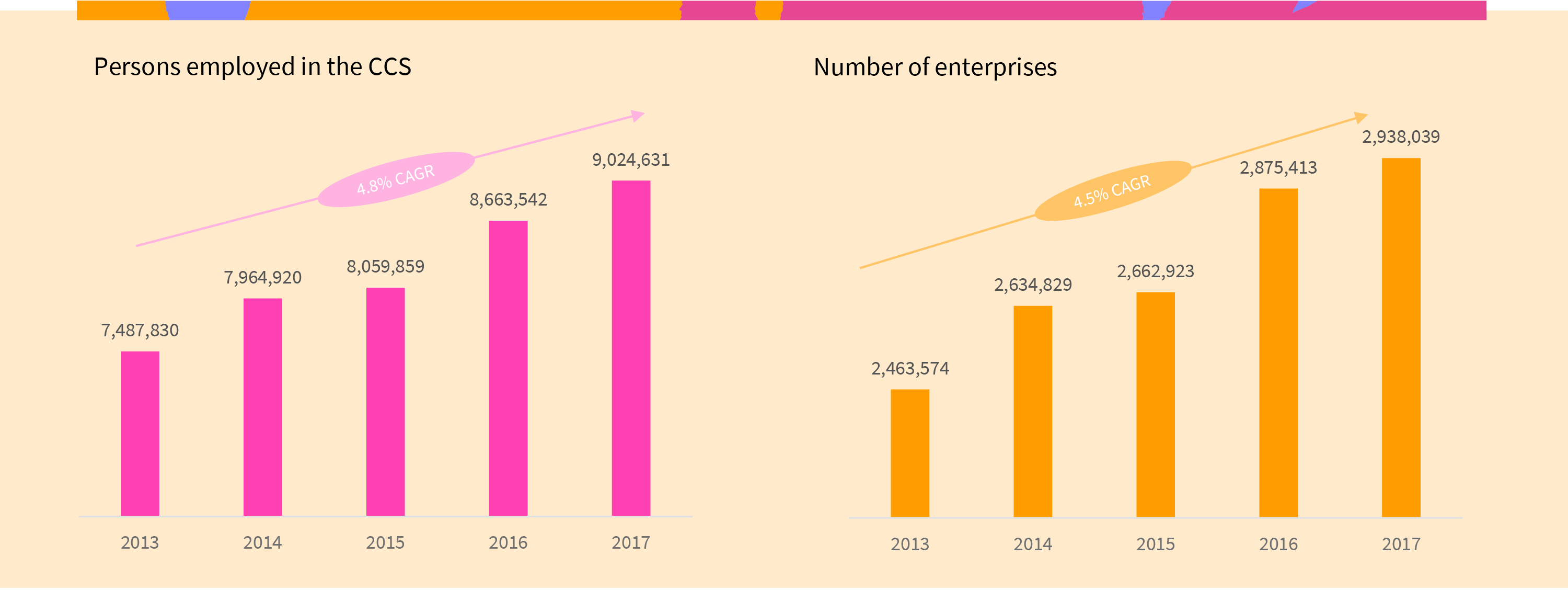

- The CCS are one of Europe’s leading job providers, employing on average 6.2% of the workforce at the Member State level.

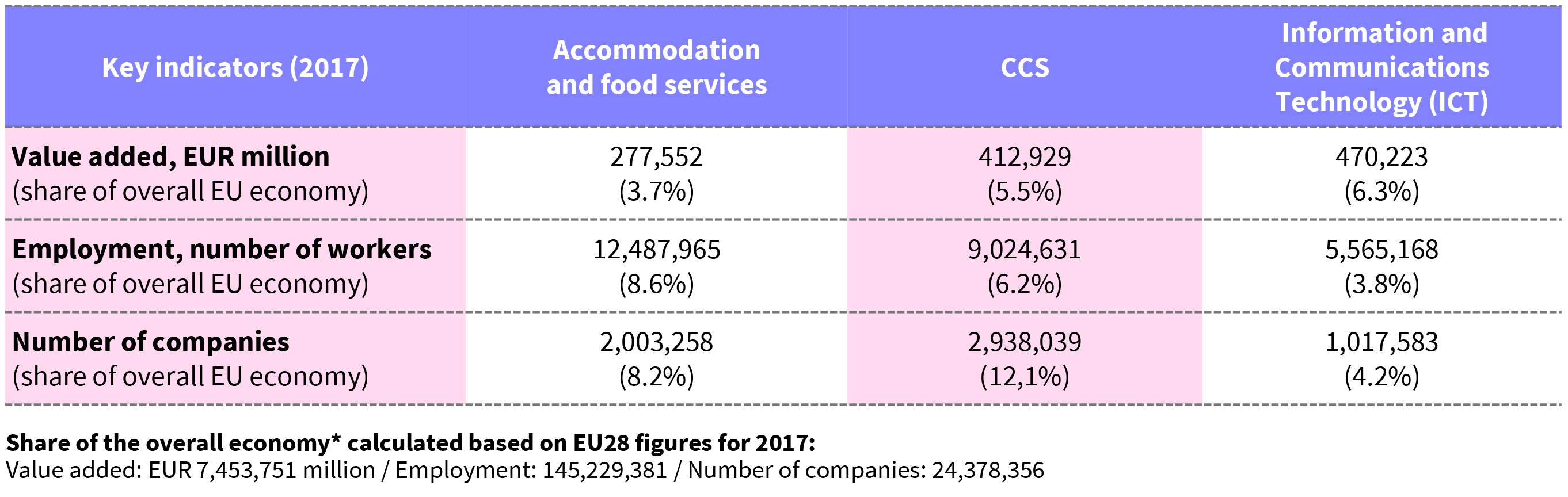

- In terms of value added and employment, the CCS are comparable to other key economic sectors such as the Information and Communications Technology and Accommodation and Food Services sectors.

- The CCS fuel content and value creation in other industries that depend on creative outputs, such as software and digital services, telecom services, tourism, consumer electronics, industrial design.

- The CCS can play a pivotal role in reshaping Europe’s post-pandemic social and economic fabric.

The study applies a broad definition of CCS, including inter alia: architecture; audio-visual and multimedia (including film, radio and television, recorded music, video games, computer programming activities); archives, libraries, museums and historical sites; books and press; performing arts; visual arts; other culture and creative activities.

CCS are a strategic asset for the EU economy

They represent a value added of EUR 413 billion

In 2017 (the latest figures available), at the EU level, the CCS accounted for a total added value of EUR 413 billion, which represents, on average, 5.5% of Member State’s value added. In countries like Cyprus, the UK, Finland and Latvia the CCS contribute more than 7% to the national value added. Over the period 2013 to 2017, the value added produced by the CCS has grown at a CAGR of 5.1%.

They employ over 9 million of people across Europe

CCS are also one of Europe’s leading job providers, employing on average 6.2% of the workforce at the Member State level in 2017. In countries like the Netherlands and Ireland this share exceeds 8%. Both employment and the number of companies in the CCS have grown strongly at an above 4.5% CAGR since 2013. CCS companies represent, on average across Member States, 12.1% of companies.

The main driver of CCS growth in Europe is the audio-visual and multimedia (AVM) subsector. The value added of the AVM subsector grew at a 7.2% CAGR between 2013 and 2017 reaching EUR 185 billion. The subsector contributes, on average, 2.5% towards value added in each Member State of the EU. The AVM subsector alone employs 1.9% of the EU workforce.

Their economic weight is comparable to other key sectors

Looking at the macro-economic indicators, the CCS are comparable to other key economic sectors such as the Information and Communications Technology and Accommodation and Food Services sectors – underlining that the CCS are a strategic asset of the EU economy.

Five key trends are reshaping the CCS

Digitalisation, increased environmental awareness, collaborative and creative hubs, legislative changes for rightsholders, and the experience economy are heavily influencing CCS’ growth and contributing to shape the CCS of tomorrow:

- The digital uptake increases access to cultural content and drives CCS growth, as CCS content is increasingly consumed digitally through the internet, social media or new digital formats (such as podcasts). In response to the shift towards digital consumption, advertisement is also moving away from traditional print media to the digital sphere.

- Thought leadership and new narratives to promote ecological sustainability is growing in importance in the CCS community. CCS, as influential actors in society, can play a prominent role in encouraging individual and societal changes toward greener policies and more sustainable consumption choices. Also, CCS are adopting sustainable practices to reduce their carbon footprint across the value chain.

- New forms of collaborations (cooperative project development between small companies/freelancers) lead to innovative models such as creative hubs and co-working spaces that can spark socio-economic development, notably in urban areas.

- A new European regulatory framework unlocks new income generation opportunities notably through improved licensing of copyrighted content. Also, new systems for exceptional authors’ rights remuneration during the COVID-19 pandemic (e.g. new remuneration models developed by Collective Management Organisations) could lead to new monetisation solutions and additional regulatory changes.

- The CCS are an integral part of the experience economy and tourism. Cultural tourism is estimated to account for up to 40% of European tourism. Additionally, cultural institutions (museums and theatres) across Europe are experimenting with new digital services in response to the COVID-19 pandemic.

About the Capacity Building programme for the Cultural and Creative Sectors Guarantee Facility

On 13 June 2018 the EIF announced the launch of a capacity building programme for financial intermediaries in the Cultural and Creative Sectors. Selected by the EIF, KEA partnered with Deloitte Digital to provide the scheme operating under the Cultural and Creative Sectors (CCS) Guarantee Facility.

The CCS Guarantee Facility is a EUR 250 million guarantee fund launched in June 2016 in the context of the Creative Europe programme. The CCS Guarantee Facility is managed by the European Investment Fund on behalf of the European Commission. It is designed to strengthen the competitiveness of the cultural and creative sectors by providing guarantees to participating financial intermediaries.

The capacity building scheme is made available to financial or credit institutions, leasing companies or loan funds as well as guarantee institutions, guarantee schemes or other financial or credit institutions from 33 countries in Europe. So far, 20 financial institutions from 13 countries are part of the scheme.

In July 2020, debt financing of EUR 424.4 million was made available to 2517 CCS SMEs to finance projects worth over EUR 2 billion.

More information

For more information, please consult the market study.

Do not hesitate to contact us if you have any question: Arthur Le Gall [alegall@keanet.eu],