On March 2nd the Be Creative – Call The Bank seminar took place in Brussels. This forms part of the CCS Guarantee Facility project in which KEA is the CCS specialist, making a bridge between the financial institutions and the CCS’ operators.

The CCS Guarantee Facility was initiated in June 2018 by the European Commission in the framework of the Creative Europe Programme, and is led by the European Investment Fund. It aims to facilitateaccess to funding for CCS companies, in order to fill the financing gap currently preventing the CCS market from scaling up and enjoying its full economic and social potential. More concretely, it means that the European Union guarantees 70% of the loans granted to CCS organisations by financial institutions which have signed up for the programme. This win-win programme is a way to bypass the reluctance of banks to take risks in investing in a market they don’t know well, while enabling the CCS easier access to debt financing.

“CCS’ access to finance through banks is hindered by low levels of mutual understanding combined with complex business models.”

This public event was the occasion to physically bring together financial institutions, European Union Institutions, professional associations and CCS players to interact and discuss the challenges of the CCS market’s development and its access to loans. The format consisted of two panel discussions and a presentation of market research on the CCS.

The seminar highlighted the increasing potential of the CCS market while making a space for the CCS

and financial institutions already supporting the creative and cultural sector to share their perspectives on the topic. In a context where CCS’ access to finance through banks is hindered by low levels of mutual understanding combined with complex business models, it was essential to bring together the CCS and financial worlds , in order to break down their mutual misconceptions and provide some first solutions through a necessary co-creative approach.

“The CCS is an attractive and growing market. It represents a key market for the EU in terms of size, employment and added value.”

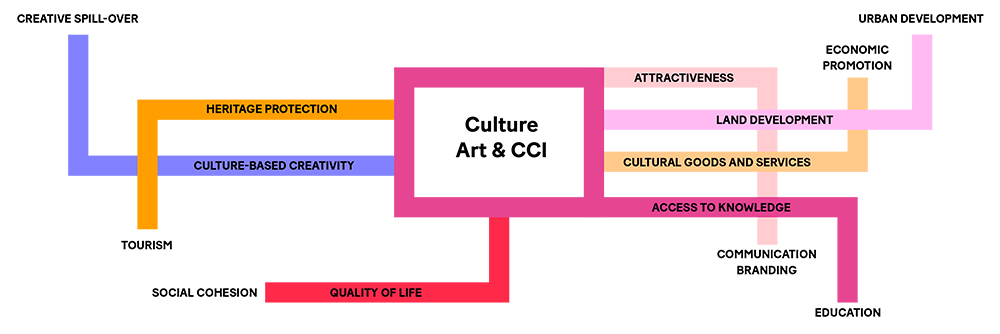

The European CCS is renowned on a global scale and counts numerous leading world brands. The market analysis figures showed that the CCS is an attractive and growing market whose economic weight is comparable to that of ICT and the accommodation and food services sectors. It represents a key market for the EU in terms of size, employment and added value. The CCS creates value that nurtures a wider range of industries dependent on creative or cultural resources. First being the content creator, art whether it is visual, performing or heritage-led provides a direct input to the cultural and creative sub-sectors and its impact even extends to a wider outreach gathering consumer electronics, telecom services, tourism, industrial design, education and software.

The funding mix of many CCS companies relies predominantly on their own resources and public support. Franky Devos, General Manager at Vooruit – a multisector art center in Ghent – shared his perspective on the financing of the CCS operators, focusing more specifically on the performing arts’ companies. He highlighted that in his experience they are dependent on public funding. His experience showed that on average “95% of companies can’t make their project happen without subsidies”. The creation process in this field takes time, between 3 to 6 months according to Franky, and the value created out of it only shows up at the end of a long process while the money would need to come in at the beginning. He pointed out the struggle of these performing art companies in guaranteeing any return on investment in advance, especially if using the logic of traditional business models with which the banking world is familiar and the evidence these models provide to convince bankers to invest in their project. Consequently, he estimated that “only 5% of performing arts operators can access banks loans” referring mostly to the biggest and most renowned players who are able to make a stronger case and provide better evidence of a tangible success.

“Only 5% of performing arts operators can access banks loans.” – Franky Devos, General Manager at Vooruit

Besides, the CCS – just like any other sector – relies on market evolutions and the emergence of new consumer habits. Digitalisation typically falls into this frame, driving organisations to adapt their offer to new audience needs and therefore embodies an opportunity for the sector to create new assets in the value chains. The Belgian comics publisher Dupuis faced this change. As digital interfaces are now part of everyday life, its family-based audience began to interact differently with its content offer.. “The digital challenge was more of a necessity than an opportunity” said Mélanie Querriaux, Business Affairs Manager at Dupuis publishers. Based on the success of webtoons on the Korean market, they decided to invest in digital comics for the European market. Not only did the webtoons enable them to recuperate an audience previously consuming their traditional comics offer , it was also a way to develop a new creative opportunity, invest in new technology and grow their revenues.

“We have to help the banks help our sector by showing them the revenue flows in our industry” – Laurent Jacobs, Group Finance Director at PIAS Belgium

The dialogue between the CCS small and medium organisations and the banks has proven difficult. “It’s a match that is not easy to make” said Edouard Meier from Creatis Brussels, a creative incubator, when talking about the creative entrepreneurs having to pitch their project to investors. Creative and cultural operators are focused on their project while financial entities are looking for concrete proof to enable them to limit the risks, however the CCS business models and value chains mostly elude them.

The CCS business models and value creation are different from the ones of more traditional industries and they need to be explained to the banking sector. Laurent Jacobs, Group Financing Director at PIAS Belgium – a leading independent records and music publisher in Europe – told us about hisdifficult journey in interacting with banks to raise funds even for a larger entertainment group. He was first very surprised to discover how little the banking world – including the large banks – knew about the sector, its revenue flows and its value creation.

“A guarantee is good but won’t be enough” – Laurent Jacobs, Group Finance Director at PIAS Belgium

The different panellists showed a great enthusiasm towards the CCS Guarantee Facility and the opportunity it embodies in enabling CCS operators to access banks funding. The financial institutions already involved in the CCS GF took advantage of this public discussion to affirm that they hadn’t taken more risks in investing in CCS companies and that cases of defaults were rare and not greater than for other sectors.

Key links:

- Watch the full stream of the seminar

- Read the market analysis of the cultural and creative sectors in Europe

- Visit the EU Guarantee Facility webpage to learn more on the project